Regardless of Who is in Leadership, The US Government is Over $35 TRILLION in Debt.

Social Security, Medicare, Medicaid, and the interest on the debt itself accounts for the majority of our annual taxes.

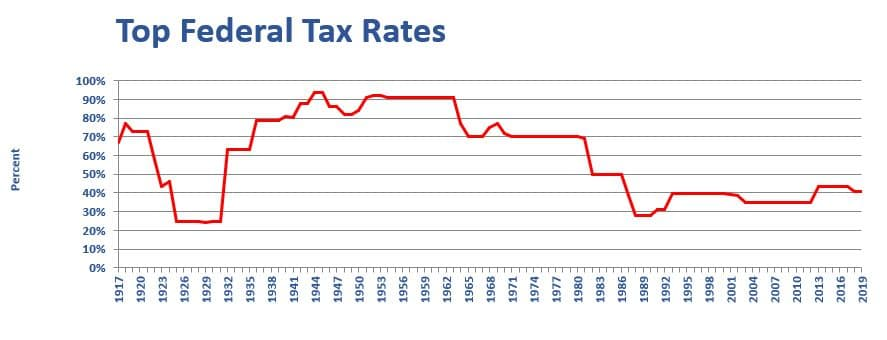

Shockingly, we currently have among the lowest taxes in US history:

How do you think the government will pay off this massive debt, let alone the interest payments?

The looming possibility:

Increased Taxes.

Learn about the tax implications of each of the buckets you can put your savings into.

Learn how to structure your savings to lower your bracket by retirement.

See real-world examples of how you can apply the same principles used by the wealthy

Dylan Whitcraft

With solid planning, financial freedom is available to ANYONE, though practical savings, compound interest, and tax strategies.

My focus is on building a relationship built on trust. Only then can I help you achieve your personal success through tailored strategies that align with your goals.

Trust-Based Relationships

Tailored, Actionable Strategies

ANY income bracket

Get a Copy of Bestseller “The Power of Zero”

No Obligations

Step one

<15 Min Call

This is NOT a sales call

Everyone’s situation is unique.

Goal: To see if the book can help you

step two

We Send The Book

Zero obligations:

The book is yours and yours alone

Shipped directly from Amazon

Step three

You Get Your Book!

Understand the tax climate

Learn how the rich do things

Pursue financial freedom!

“Must read. I wish I knew about this book when I was in my 20’s. But it’s never too late.”

-Hidemi

If taxes will be higher in the future, why not pay the tax on our retirement portfolios now, while taxes are at low levels we haven’t seen in our lifetimes?